Table of Contents

- What Are Self-Assessment Tax Returns?

- When Are Self-Assessment Tax Returns Due?

- Self-Assessment Tax Returns Deadline

- When To Send Self-Assessment Tax Return

- Does Everyone Have To Do A Self-Assessment Tax Return?

- Do I Need A Self-Assessment Tax Return?

- What Do I Need For A Self-Assessment Tax Return?

- Can I Do My Own Self-Assessment Tax Return?

- How Do I Know If I Need To Do A Self-Assessment Tax Return?

- Register For Self-Assessment Tax Return

- How Often Do You Do Self-Assessment Tax Return?

What Are Self-Assessment Tax Returns?

Self-Assessment Tax Returns are forms used by HM Revenue & Customs (HMRC) to collect income tax from individuals. They are essential for reporting earnings beyond regular employment, such as:

- Profits from self-employment,

- Rental income

- Foreign income

- Savings interest and/or dividend income

- Investment returns

- Any other income including child-benefit if you are a higher income earner.

The self-assessment tax return can provide an opportunity for those seeking to apply for tax reliefs or allowances.

When Are Self-Assessment Tax Returns Due?

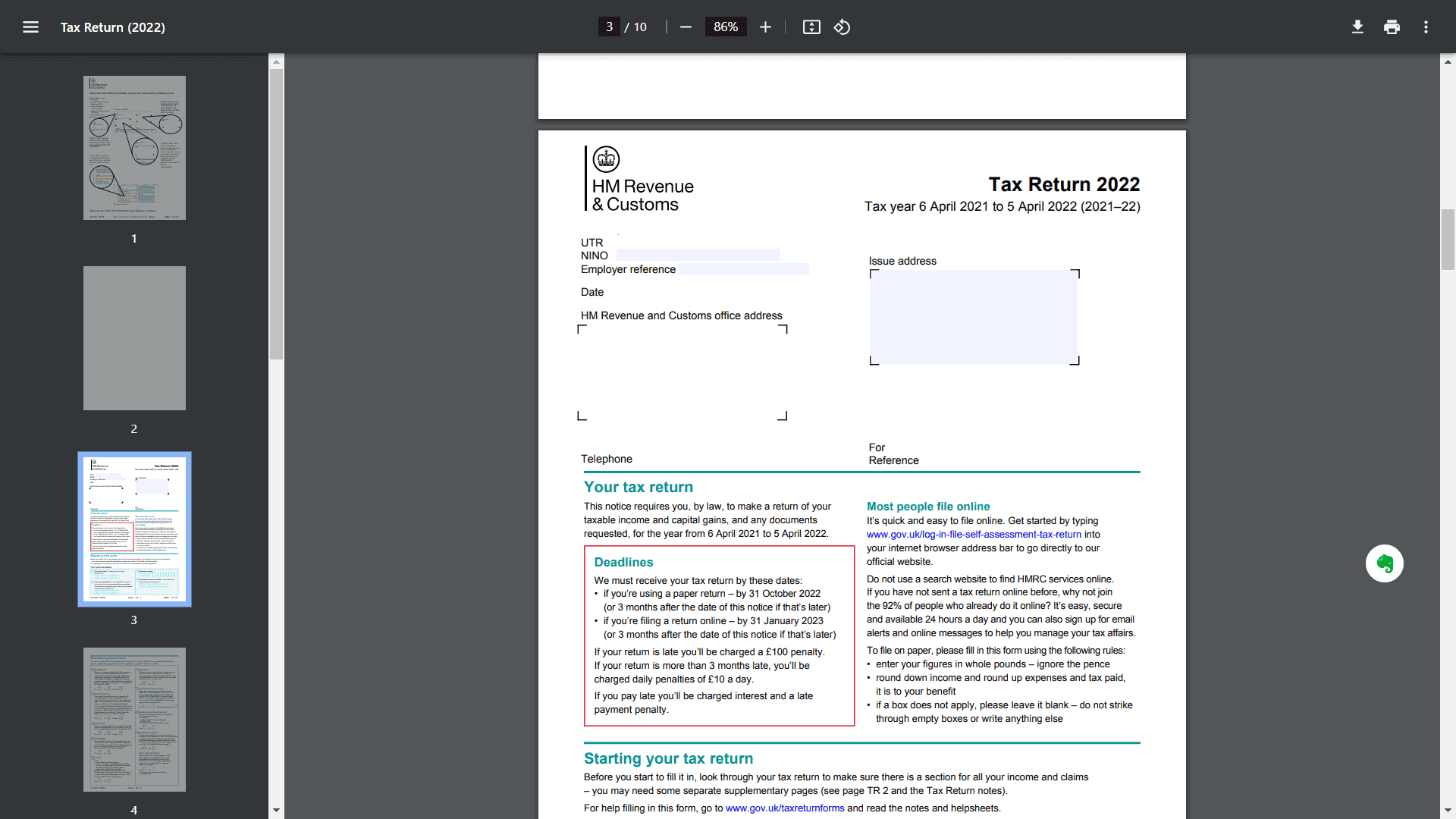

The deadline for filing online Self-Assessment Tax Returns is:

- 31st January following the end of the tax year for online submission.31st January 2024 is the deadline for income tax relating to the year to 5th April 2023.

- 31st October of the same year for submitted paper returns.31st October 2023 is the filing deadline for income tax relating to the year ended 5th April 2023.

Self-Assessment Tax Returns Deadline

Missing the Self-Assessment deadline can result in penalties starting from £100 if within 3 months.

Further delays would lead to additional fines and interest on owed taxes. To estimate the penalties you can use the following calculator provided by HMRC.

Late payment interest would also be due if payments are the deadline. The rates of interest can be found on the HMRC website.

If your tax liability exceeds £1,000 you would be asked to make a payment on account 31st July in advance of the following tax year. This would be calculated on about 50% of the tax liability for the previous year. For those submitting Self-assessment tax returns for the first time, this can be a shock to your cashflow.

When To Send Self-Assessment Tax Return

It is advisable to send your tax return well before the deadline or 31st January (for online filing) or 31st October (for paper filing – see above).

This allows time to gather all necessary information and avoid last-minute issues that could lead to a late submission.

If you are due a tax refund it is even more beneficial to submit your return early to get prompt repayment.

In order to file the return you would need to obtain and collate the relevant information to include on the submission. This can take time and require calculations, so it is important to bear this in mind.

Does Everyone Have To Do A Self-Assessment Tax Return?

Not everyone needs to file a Self-Assessment Tax Return. It’s mandatory for the:

- Self-employed

- Company directors (even with no income)

- Landlords with property income

- Higher income earners that are also claiming child-benefit

- Those earning income from foreign source

- Earning savings interest and/or dividend income

- Those earning from other sources of income

Do I Need A Self-Assessment Tax Return?

If you’re unsure whether you need to file, check if you have untaxed income, significant savings or investment income, or income from abroad, among other factors.

It is advisable to use the following HMRC checklist.

What Do I Need For A Self-Assessment Tax Return?

You will need accurate records of your income and expenses. This would include:

- P60 and/or P45 forms

- P11D form

- Child-benefit details

- Savings Interest amounts

- Dividend vouchers

- Rental income and expenses

- Pension income or contributions made

- Charitable donations

- Proceeds from the sale or businesses or investments.

- any other relevant documentation

Can I Do My Own Self-Assessment Tax Return?

Yes, you can prepare and file your on Self-Assessment Tax return with HMRC online.

If you have one or two sources of income it may be more advisable and straight-forward to prepare and submit the return yourself. HMRC provides resources to help, but you must be comfortable with legal financial documentation.

However, many people find the HMRC portal difficult to navigate and can often miss out on claiming reliefs, deductions or allowances that would reduce their tax liabilities. An accountant can advise, prepare and submit your Self-Assessment tax return on your behalf and take the stress out of the process on your behalf.

If you have multiple sources of income it is also advisable to hire an accountant to help prepare and submit your return.

At Bluestone Advisory Ltd we have qualified, experienced accountants that can deal with your tax affairs with confidence. We provide personalised attention to your needs that you can trust. Contact us to assist you.

How Do I Know If I Need To Do A Self-Assessment Tax Return?

HMRC usually sends a notice if you need to file a return. Alternatively, if you’ve had a change in income or personal circumstances, it’s worth using the following checklist provided by HMRC.

Register For Self-Assessment Tax Return

Registration involves:

- Setting up a HMRC Self assessment online account

- Request a Unique Taxpayer Reference (UTR). This would be sent to you by post and can take a number of weeks to obtain.

How Often Do You Do Self-Assessment Tax Return?

Most individuals need to complete a Self-Assessment Tax Return every year. However, if your tax situation changes, you may need to register for Self-Assessment or update your existing details with HMRC.

Bluestone Advisory Ltd – Accountants in South London

At Bluestone Advisory Ltd, we are dedicated to delivering expert accounting solutions with a personal touch. Based in the heart of South London, we cater for small businesses, medium-sized businesses and charities across a wide range of industries.

We tailor our services to meet your unique needs. Our trusted, qualified accountants in South London with over 15 years of experience are here to help you with:

- Self-Assessment tax returns in South London

- Partnership accounts and tax returns in South London

- LLP accounts in South London

- Limited company accounts in South London

- Corporation Tax services in South London

- Charities accounting in South London

- Bookkeeping services in South London

- Management accounting in South London

- VAT compliance and advice in South London

- Payroll services in South London

Reach out to us a free consultation with our friendly staff today and let’s drive towards your business goals.

For local, small business accountants in South London contact us today!